OUR BLOG

Columbia Grain International seeks ‘refreshed strategic direction

After 32 years in various management positions with Columbia Grain International (GCI), Kurt Haarmann recently ascended to the captain’s seat of the Portland, Oregon, US-based company. His mission: navigate CGI…

Read more

South Africa’s corn exports on rise

A positive outlook for South Africa’s 2025-26 corn crop following the previous season’s strong harvest is leading to oversupply in the domestic market, with exports anticipated to increase amid lacklustre…

Read more

Brazil’s corn production to dip slightly

Corn production for Brazil in marketing year 2025-26 is expected to decline by 2% from the previous year due to lower yields, though higher carryover from a strong 2024-25 harvest…

Read more

Focus on Argentina

Argentina is preparing for a bumper wheat crop, matching the record set in 2021-22, but prices are lagging and the government is trying to stabilize the nation’s economy, which is…

Read more

US grain growers applaud larger vital minerals list

The addition last week of phosphate and potash to a government list of 60 minerals critical to US security was cheered by large US agricultural organizations. The Department of the…

Read more

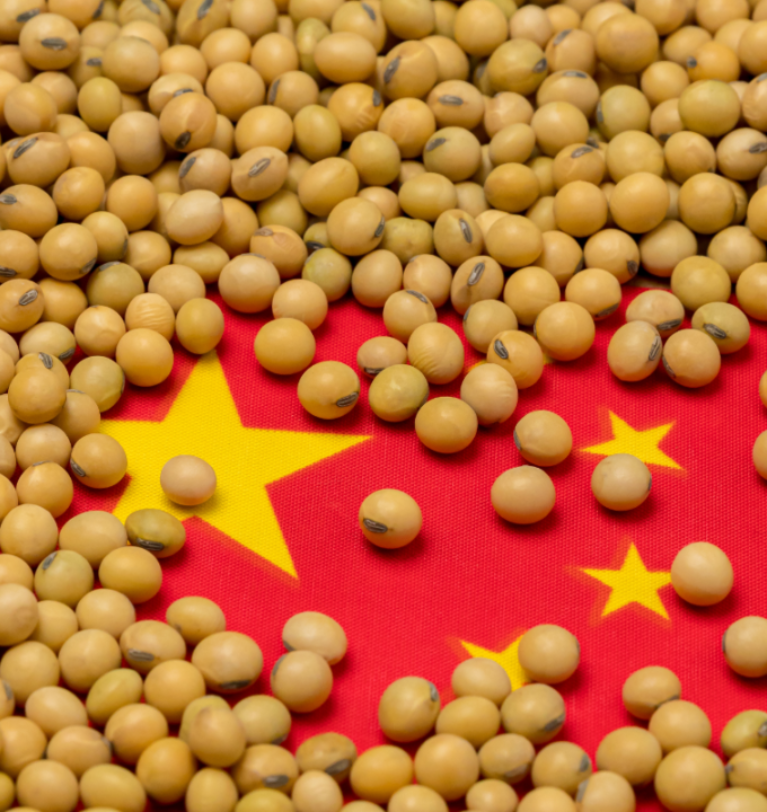

US-China deal opens door for soybeans

After months of negotiations and no 2025-26 marketing year purchases of soybeans until earlier this week, the United States and China on Oct. 30 agreed to a new trade framework…

Read more

IGC: Grains production outlook rises again

Better-than-anticipated wheat and barley yields have boosted the forecast for total grains (wheat and coarse grains) production in the 2025-26 marketing year, according to the International Grain Council’s (IGC) most…

Read more

Focus on Vietnam

Vietnam is in the midst of its most extensive restructuring plan, aiming to create a leaner, more responsive government that drives economic growth and propels the country from a modern…

Read more

USDA raises wheat production estimate

The National Agricultural Statistics Service of the US Department of Agriculture (USDA) in its Small Grains Summary 2025 issued Sept. 30 estimated wheat production in the United States this year…

Read more

Country Focus: Egypt

Egypt, one of the world’s top importers of wheat, saw its imports significantly drop in the first half of 2025 as the nation acclimated to a new state agency responsible…

Read more

Focus on China

In the midst of a trade war with the United States, China is developing a dedicated soybean supply chain with Brazil that is specifically tailored to China’s sustainability and quality…

Read more

China soybean imports continue surge

China, the world’s largest soybean consumer, set a second straight monthly import record in July, Reuters reported, citing customs data calculations. China brought in 11.67 million tonnes of soybeans in July, data…

Read more

Cargill to exit Vietnam aquafeed business

Cargill said it is exiting the aquafeed business in Vietnam as part of a strategy realignment, which will include closing three facilities. “After a thorough assessment of our aqua business,…

Read more

Analyzing the Booming Global Demand for Canadian Lentils in 2025

At Warwyck Foods, we pride ourselves on being at the forefront of agricultural market insights, especially when it comes to a product as vital and versatile as Canadian lentils. As…

Read more

Bulgaria oilseed production to rebound

After three consecutive years of hot and dry conditions, Bulgaria is expecting an increase in rapeseed and sunflower seed production in marketing year 2025-26 due to more favourable weather and…

Read more

Australian winter crops poised for strong year

In its first report on the 2025-26 winter crop, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) projects production to decrease 8% year on year to 55.6…

Read more

Partnership sources Ukrainian grain

Al Dahra, a United Arab Emirates-based global agribusiness, is partnering with Getreide AG Ukraine through an exclusive agreement to establish grain sourcing operations that support its global growth and supply…

Read more

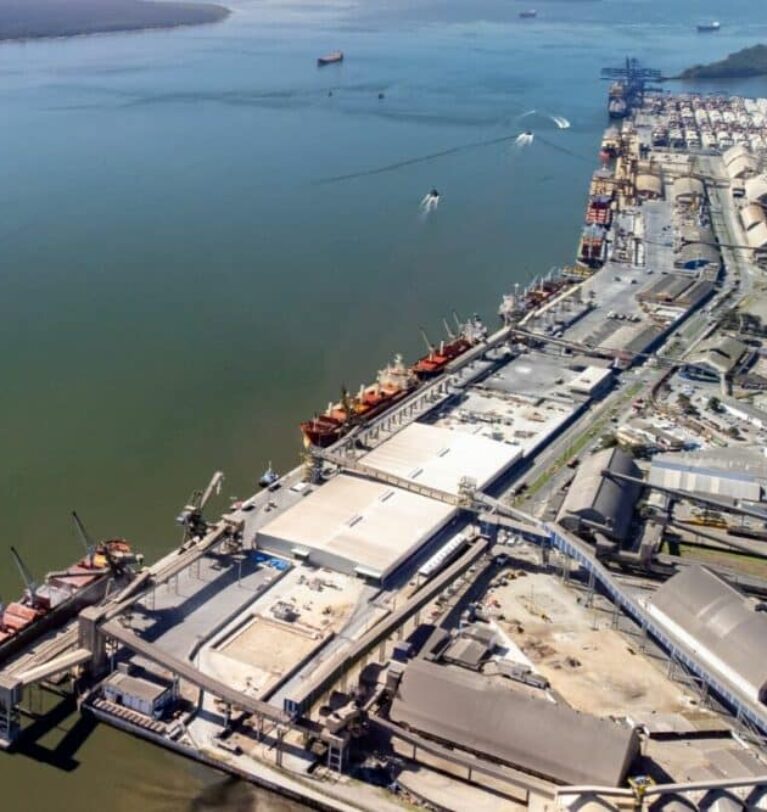

Cargill, LDC win site bids at Brazilian port

Cargill and a consortium formed by Louis Dreyfus Co. and Brazilian grain trader Amaggi (ALDC) were among the winners of a competitive auction to operate three terminals at the Port…

Read more

P&H acquires Port of Quebec export terminal

Parrish & Heimbecker, Ltd. (P&H), a Canadian, family-owned agribusiness, has acquired a deep-water bulk marine export terminal at the Port of Quebec in Quebec City from Société en Commandite Terminal…

Read more

US soybean market ready to rise

Since August, CME Group soybean oil futures have been locked in a 10¢-trading range. Near-record soybean production from the 2024 crop, coupled with the inauguration of US President Donald Trump…

Read more

Tariffs provoke uncertainty for commodities as traders balk

Agriculture industry analysts say the constantly shifting landscape of US tariffs, retaliatory actions, reciprocal tariffs, and possible delays makes the uncertainty of the situation almost as bad as the tariffs…

Read more

brazil / Business / Business & Strategy

Record-setting soybean crop expected in Brazil

Brazil, the world’s largest producer and exporter of soybeans, is forecast to set records in those categories in the 2025-26 marketing year, according to a report from the Foreign Agricultural…

Read more

Argentina / Business & Strategy

Argentina’s soybean crop stabilizes

Showing signs of recovery from drought that has persisted through January, Argentina’s soybean crop is forecast to reach 49 million tonnes in marketing year 2024-25, the same as 2023-24, according…

Read more

China ups 2025 grain production goal

Reuters reported, citing a government report, that China has set higher grains and oilseeds production targets and increased its 2025 budget for storing agricultural commodities. This is to secure its long-term food…

Read more

Turkey gradually increasing wheat imports

With ending stocks having been whittled down thanks to measures taken by the Turkish government to reduce excess inventory, the country’s wheat imports are expected to increase in the second…

Read more

Trade results contribute to The Andersons earnings

An early harvest boosted the Trade segment of The Andersons’ results, making a significant contribution to the fourth quarter ended Dec. 31, 2024. Net income at The Andersons in fiscal…

Read more

Brazil’s grains production in record territory

Greater planted area and a recovery in productivity have Brazil poised to harvest 325.7 million tonnes of grains for the 2024-25 season, according to the National Supply Company’s (Conab’s) recently…

Read more

Trade war averted, but US tariff threats remain

A trade war between the United States, Canada and Mexico was averted on Feb. 3 as the three countries’ leaders reached agreements to pause any actions for 30 days. The…

Read more

Canada: Durum production down 12%

Production of Canada’s principal field crops is expected to decrease in 2025-26, Agriculture and Agri-Food Canada (AAFC) said in its preliminary outlook for 2025-26 Canadian supply and demand. Forecasted increases…

Read more

Rains slow Brazilian soybean harvest

Excessive rains have bogged down Brazil’s soybean harvest for the 2024-25 season, and unfavourable weather has delayed the planting of the second corn crop, Reuters reported, citing agribusiness consultancy AgRural. As…

Read more

Bunge deal to acquire Viterra gets OK from Canada

With a raft of conditions, the Canadian government has given the green light to Bunge Global SA’s 18-month-old deal to merge with fellow agribusiness giant Viterra. Anita Anand, minister of…

Read more

India’s rice stocks reach record high

While its wheat stocks continue to drop, India’s rice stocks hit a record at the beginning of January, reaching eight times the government’s target, Reuters reported. Rice reserves totaled 60.9 million tonnes…

Read more

FAS bullish on Argentine soybean crop

Strong soybean production and crush are anticipated in Argentina in the 2024-25 marketing year, but those lofty projections could be impacted by a developing La Niña weather pattern, according to…

Read more

Dryness expected in Brazil, Argentina

La Niña still has not evolved after various computer forecast models predicted it was imminent since last spring. Changes in ocean surface temperatures finally have become significant enough that traditional…

Read more

CPKC doubles capacity at US-Mexico border with new bridge

Canadian Pacific Kansas City (CPKC) completed construction of a new international railway bridge that more than doubles its capacity at the US-Mexico border. The Patrick J. Ottensmeyer International Railway Bridge…

Read more

Business / fertilizer / IMPORT / REPORT

New grain terminal opens in Saudi Arabia

National Grain Co., a joint venture between the Saudi Agricultural and Livestock Investment Co. (SALIC) and Bahri, inaugurated the Yanbu Grain Handling Terminal on Dec. 22 at Yanbu Commercial Port.…

Read more

Business / Business & Strategy / REPORT / Viterra

Heat, dryness expected in Brazil

Most of the commodity trade fear of La Niña negatively influencing South America has passed. Weather conditions since the end of October have been mostly very good in Brazil and…

Read more

Viterra drops plans to acquire Cargill sites in South Australia

Viterra no longer plans to acquire the South Australian GrainFlow handling and storage sites and mobile ship loader from Cargill, and the companies have withdrawn their application from the Australian…

Read more

brazil / Business / Business & Strategy / EXPORT / REPORT / US Wheat

Brazil expecting record grain output

Brazil is anticipating a bin-busting grain harvest in the 2024-25 marketing year, according to a report from the National Supply Company (Conab), released on Dec. 12. Conab forecasts record grain…

Read more

Biofuel / Business / Business & Strategy / EXPORT / UKRAINE / US Wheat

Russia to cut wheat exports

Reuters reported, citing the Russian government, that Russia, the world’s leading exporter, plans to cut its wheat export quota by two-thirds in 2025. It will also hike wheat export duties…

Read more

Playing Russian roulette with fertilizers

Russian fertilizer exports are booming, largely driven by soaring sales to European customers. This trend sparks fierce debates in Europe on whether to restrict fertilizer flowing from the east, which…

Read more

Biofuel / Business / Business & Strategy / REPORT

Biofuels preparing to take flight

After soaring in the early 2000s only to see more modest growth in recent years, the biofuels industry might be on the verge of flying high again … about 35,000…

Read more

Business / Business & Strategy / US Wheat

Rain improves US Plains wheat conditions

Recent rainfall has quickly changed the direction of winter wheat crop conditions in the US central and southern Plains. Growers hope additional rain in forecasts signals a pattern change to…

Read more

Business / Business & Strategy / REPORT

Renewables, Trade segments boost The Andersons earnings

Strong renewables production and improved results in the Trade segment boosted The Andersons net income attributable to the company to $27 million, equal to 80¢ per share on the common…

Read more

Business / Business & Strategy / REPORT

US grain exports in all forms increase 26%

Exports of US grains in all forms increased by 26% to 109.4 million tonnes in the 2023-24 marketing year, according to data released by the US Department of Agriculture (USDA).…

Read more

Business / Business & Strategy / REPORT

Drought stymies Brazilian grain shipments

A severe drought in northern Brazil has significantly lowered water levels on the Tapajos waterway, halting grain shipments. Brazilian port terminal group Amport, which represents firms such as Cargill and…

Read more

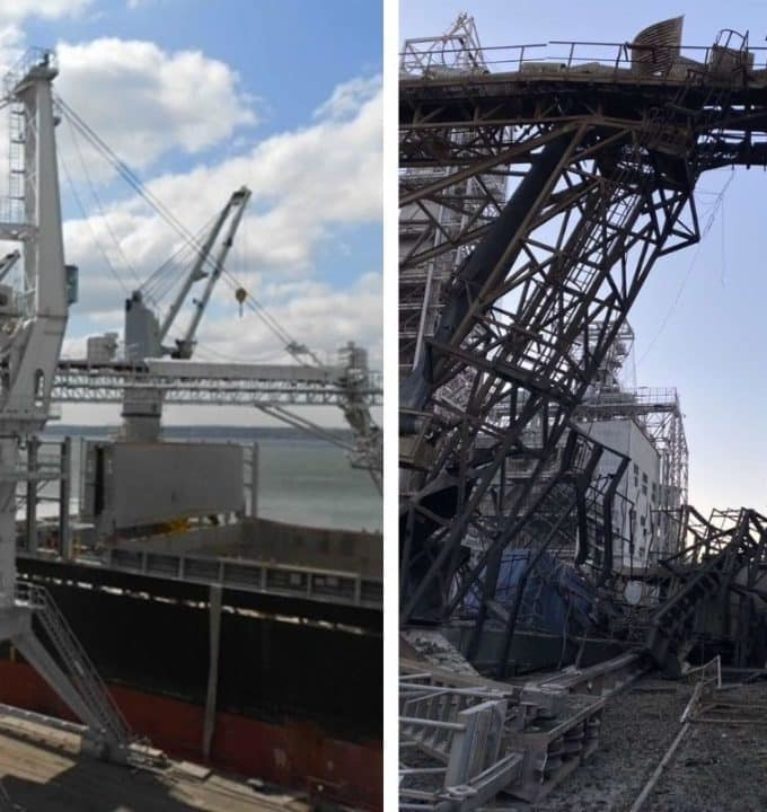

Business / Business & Strategy / REPORT / UKRAINE

Russian missiles strike grain ships

A Russian missile struck a grain vessel docked at the Port of Odesa on Oct. 7, killing one person and injuring five crew members, Reuters reported, citing Ukrainian officials. It was the…

Read more

Business / Business & Strategy / EXPORT / REPORT

India ends non-basmati rice export ban

The Indian government will resume non-basmati white rice exports with a minimum floor price of $490 per tonne, ending a ban that started in July 2023. The government has gradually…

Read more

Business / Business & Strategy / EXPORT / REPORT

Egypt expected to produce more wheat in 2024-25

According to a report from the Foreign Agricultural Service (FAS) of the US Department of Agriculture, Egypt is expected to produce more wheat in 2024-25 as the government encourages an…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Grains and oilseeds powerhouse

The presence of two of the world’s most important agricultural producers and exporters — Brazil and Argentina — makes South America a powerhouse of world grains and oilseeds production and…

Read more

Business / Business & Strategy / REPORT

Brazil’s grain production dips in 2023-24

Grain production in Brazil is estimated at 298.41 million tonnes for the 2023-24 marketing year, a drop of 21.4 million tonnes compared to the previous year, according to Conab, the country’s…

Read more

Business / Business & Strategy / REPORT

US confined space incidents decrease in 2023

According to researchers at Purdue University, the number of documented agricultural confined space incidents in the United States decreased 34% in 2023 compared to the previous year. The total was…

Read more

Business / Business & Strategy / REPORT

Future looks bright for pulses

High in protein and fiber and relatively inexpensive compared to meat, pulses are gaining favor among global consumers. And because of their natural soil-enhancing and greenhouse gas-absorbing properties, pulses also…

Read more

Business / Business & Strategy / REPORT

Dryness stressing Ukraine, Russia crops

As if the Russia/Ukraine war was not enough to deal with, the region has been enduring a very dry summer. Crop stress in the region is peaking for the third time this…

Read more

Business / Business & Strategy / REPORT

Corn futures dip to four-year lows

The bulls seem to have abandoned corn futures and are giving few indications they expect to return anytime soon. On Monday, Aug. 26, the CME Group September and December contracts…

Read more

Business / Business & Strategy / REPORT

Be8 breaks ground on ethanol plant

Be8, a Brazilian renewable energy company, said it has agreed with Praj, an Indian company and global leader in bio-energy, to establish its first ethanol plant in Passo Fundo, Rio…

Read more

Business / Business & Strategy / REPORT

Brazil corn production, exports to drop

Brazil expects to harvest 4.6 billion bushels (116.8 million tonnes) from its three corn crops in the 2023-24 season, a drop of 12% from last year’s record harvest, according to…

Read more

Business / Business & Strategy / ORGANIC FOOD

USDA lowers US wheat production estimate

The US Department of Agriculture (USDA) on Aug. 12 lowered its estimate for US all-wheat production this year based on forecasts for lower soft red winter, other spring and durum…

Read more

Business / Business & Strategy / ORGANIC FOOD

Cargill earns two BIG Sustainability Awards

Business Intelligence Group (BIG) has named Cargill the winner of a pair of 2024 BIG Sustainability Awards in recognition of the company’s global efforts within the agriculture and food value…

Read more

Business / Business & Strategy / REPORT

Canada funds work to develop more resilient soybeans

The government of Canada awarded up to C$2.3 million over four years to Performance Plants Inc. (PPI) to develop change-resistant, high-yielding soybeans. The award is through the AgriScience Program–Projects Component,…

Read more

Business / Business & Strategy / REPORT

Canada, Russia wheat production threatened by dryness

A recent insurgence of heat and dryness in western and south-central Canada’s Prairies has raised concern about spring cereal production. The region had one of its best starts to the…

Read more

Grain market review: Coarse grains

The last several weeks have seen a mixed trend for maize (corn), although there was weakness in the United States on planting and yield expectations. The July World Agricultural Supply…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

USDA: largest spring wheat production since 2020

When scouts fan out across North Dakota fields in the third week of July, they will be looking to confirm or moderate expectations of a high-yielding spring wheat crop forecast…

Read more

Business / Business & Strategy / REPORT

US wheat, corn, soybean stocks up from 2023

The US Department of Agriculture (USDA) on June 28 said domestic stocks of wheat, corn and soybeans on June 1 were up more than 20% from a year earlier. The…

Read more

Business / Business & Strategy / REPORT

Key US crop areas battle too much, too little rain

Weather typically is the main force affecting agricultural commodity markets, from planting in the spring (or fall for winter wheat) to harvest in the fall (or summer for winter wheat),…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Grain market review: Oilseeds

The prospect of ample supplies, despite weather problems in some producing regions, is pushing oilseeds prices lower. The Foreign Agricultural Service (FAS) of the US Department of Agriculture said on…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

COFCO, GROWMARK enter agreements on grain assets

COFCO International, Ltd. and GROWMARK Inc., on June 20, announced they have entered into definitive agreements regarding grain assets in Illinois. Beijing, China-based COFCO International has agreed to purchase GROWMARK’s…

Read more

Business / Business & Strategy / REPORT

COCERAL increases EU grain outlook

In its latest 2024 European Union/United Kingdom grain crop forecast, released on June 10, COCERAL increased its projection slightly to 296 million tonnes, about 500,000 tonnes higher than the previous…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Turkey bans wheat imports

The Turkish Agriculture Ministry recently announced that it will halt wheat imports from June 21 through mid-October to protect Turkey’s farmers from price decreases and other adverse impacts during this…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Australian winter crop totals expected to increase 9%

Australia’s overall winter crop production is expected to increase 9% to 51.3 million tonnes in 2024-25 and be the fifth highest on record, according to the June report from ABARES.…

Read more

Business / Business & Strategy / REPORT

Bunge, Zen-Noh to buy stake in Brazil terminal

Bunge Global SA and Zen-Noh Group have agreed through a joint venture to purchase 50% of a grain terminal at the Port of Santos from Brazilian rail operator Rumo for…

Read more

Business / Business & Strategy / REPORT

Untimely rains impacting French grains

Recent rains have dampened France’s wheat and barley outlook while slowing maize (corn) planting in the European Union’s largest grains producer, Reuters reported, citing data from farm office FranceAgriMer. A warm,…

Read more

Grain market review: Wheat

As harvests approach, the focus for wheat traders is increasingly on the weather, especially its impact on Russia’s crop with low moisture earlier in the year and continued cold temperatures…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

India’s wheat stocks drop to 16-year low

India’s wheat stocks in government warehouses on May 1 reached their lowest level since 2008 with a 10.3% year-on-year drop, Reuters reported. Two years of low crops resulted in the…

Read more

Business / Business & Strategy / REPORT

US, Russia may hold key for bullish market

A ridge of high pressure evolved recently over the heart of Russia’s grain production region grabbing some attention in the commodity trade. Ridges of high pressure aloft over Russia tend…

Read more

Business / Business & Strategy / REPORT

Larger second crop to boost Argentina’s soy production

Argentina’s soybean production is expected to increase in 2024-25, with a larger planted second soy crop, according to a report from the Foreign Agricultural Service (FAS) of the US Department…

Read more

Business / Business & Strategy / REPORT

New Orleans leads global grain ports

The port region of New Orleans, Louisiana, US, was the world’s No. 1 grain and oilseeds export hub in 2023, leading the two major South American hubs, according to a…

Read more

Business / Business & Strategy / REPORT

Canada may see 5% boost in wheat output

Canada’s grain output in the upcoming marketing year is forecast to increase by nearly 5%, boosted mainly by a surge in wheat production, according to a report from the Foreign…

Read more

Business / Business & Strategy / EXPORT / IMPORT

Argentina investing in new grain port

The Argentine government said it plans to invest approximately $550 million to build a new grain port in the Rosario region. The region is considered a vital agricultural center for…

Read more

Business / Business & Strategy / EXPORT / REPORT

USDA: Corn, wheat acres down; soy up

The US Department of Agriculture’s (USDA) March 28 Prospective Plantings report provided a few surprises along with insight into potential 2024 acreage and crop sizes. This year’s report comes with…

Read more

Business / Business & Strategy / REPORT

CoBank: Grain, oilseed prices continue to slide

Grain and oilseed prices continued to slide last quarter under pressure of a strengthening US dollar, arrival of the South American harvest and plentiful domestic inventories, according to a new…

Read more

Business / Business & Strategy / REPORT / UKRAINE

Ukraine to plant more oilseeds.

While Ukrainian farmers are expected to plant more oilseeds, with the exception of sunflowers, production volumes in 2024-25 could be dampened by lower yields. Soybean production area is estimated at…

Read more

Focus on Thailand

Although rice production is holding steady, weather-related challenges are a constant worry for Thailand, which relies heavily on the crop as a food staple and export commodity. More than 60%…

Read more

Business / Business & Strategy / EXPORT / REPORT

Brazil’s corn and wheat crops revised lower.

Due to adverse weather conditions related to El Niño, the Foreign Agricultural Service (FAS) of the US Department of Agriculture has lowered its forecast for corn and wheat production in…

Read more

Business / Business & Strategy / IMPORT / REPORT

Japan’s corn use, imports expected to rise

Corn imports and consumption are forecast to increase in Japan for marketing years 2023-24 and 2024-25 as the country’s poultry layer population recovers from outbreaks of highly pathogenic avian influenza…

Read more

Business / Business & Strategy / REPORT

Grain market review: Coarse grains

Short covering by funds, in the absence of new bearish news, sparked a small-scale recovery in maize (corn) prices, following recent declines. The European Confederation of Maize Production (CEPM) in…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Focus on Saudi Arabia

Saudi Arabia produced nearly double the wheat expected in the 2022-23 marketing year and is on track for similar results in 2023-24 as government purchase prices remain high. Production totaled…

Read more

Business / Business & Strategy / REPORT

Cargill offers canola program in Canada.

With a rising interest in canola as a renewable fuel feedstock, Canadian growers will be able to access new and growing markets through the Cargill Power Canola program, which will…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT / UKRAINE

Discord impacting EU grain, feed industries

Intensifying protests have left the Ukrainian-European Union (EU) border nearly paralyzed, jeopardizing one of the export lifelines of the reeling Ukrainian economy. The rally backed by farmers all over the…

Read more

Business / Business & Strategy / REPORT

Rains boost Australia’s summer crops.

Summer crop prospects for Australia were pronounced “excellent” following well-timed rains in eastern growing areas that boosted expectations for production to 4.3 million tonnes, according to the Australian Bureau of…

Read more

Business / Business & Strategy / EXPORT / IMPORT

Shifting population and income levels shape global ag demand

Changes in population and income levels will shift food demand and placement of corporate assets, Michael Zerr, long-term model lead, Cargill, Minneapolis, Minnesota, US, told attendees at the opening session…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Grain market review: Oilseeds

The popularity of soybeans with US producers, as they plant for 2024-25, has put pressure on prices, particularly following an upward revision to the US Department of Agriculture’s (USDA) planted…

Read more

Business / Business & Strategy / REPORT

Study details Ukraine war’s wheat market impact.

As the second anniversary of Russia’s invasion of Ukraine draws near, a recently published research paper on the long-term impact the war has had on global wheat prices and market…

Read more

Business / Business & Strategy / EXPORT / REPORT

Argentina’s wheat production improves

Wheat production in Argentina for 2023-24 is higher than originally expected as yields improved, according to a report from the Foreign Agricultural Service (FAS) of the US Department of Agriculture.

Read more

Business / Business & Strategy / REPORT

Drought lowers Canada’s 2023-24 wheat production.

Despite a larger planted area, Canada’s wheat production in 2023-24 dropped 7% from the previous year to 31.95 million tonnes, according to a report from the Foreign Agricultural Service (FAS)…

Read more

Business / Business & Strategy / EXPORT

High prices reducing India’s corn exports

Corn exports from India have plummeted recently as domestic prices have surged due to strong demand from the country’s poultry and ethanol industries, Reuters reported, citing several exporters. The sources…

Read more

Business / Business & Strategy / REPORT

Black Sea nations ally to clear mines

Turkey, Romania and Bulgaria have signed a memorandum of understanding to find and clear drifting sea mines in the Black Sea to facilitate safe transport of Ukrainian grain exports, Bloomberg…

Read more

Business / Business & Strategy / EXPORT / REPORT

Brazil’s soybean production revised to lower.

Although Brazil’s latest soybean production forecast for the 2023-24 marketing year has been revised lower to 158.5 million tonnes, it still would top last year’s record total, if realized, according…

Read more

Business / Business & Strategy / REPORT

Brazil to expand share of global soybean trade

Brazil’s share of global soybean trade could increase to 60.6% by 2033, according to a study released last week by the US Department of Agriculture’s Economic Research Service (ERS).

Read more

Business / Business & Strategy / REPORT / UKRAINE

Geopolitics’ impact on global grain market

When Russia signed an agreement in October to supply China with 70 million tonnes of grain, legumes and oilseeds over the next 12 years, a comment made several years ago…

Read more

Business / Business & Strategy / EXPORT

EU 2023-24 grain output revised lower

Extreme weather conditions across the European Union (EU) has reduced grain production projections for marketing year 2023-24, although output is still anticipated to exceed 2022-23 levels, according to a report…

Read more

Business / Business & Strategy / REPORT

FAO: Global cereal prices decline in November

Due mainly to declines in international corn and wheat prices, the United Nations’ Food and Agriculture Organization’s (FAO) Cereal Price Index for November decreased by 3% from the previous month,…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Ukraine grain exports down sharply from last year

Ukraine’s grain exports are continuing to fall significantly behind the pace a year ago, with 13.4 million tonnes exported so far, compared to 18.3 million tonnes last year, according to…

Read more

Business / Business & Strategy / EXPORT / REPORT

Russia forecasting record grain exports

With nearly 98% of its harvest collected, Russia is forecasting over 65 million tonnes of grain exports during the 2023-24 marketing season, Reuters reported, citing Russian news agency Interfax. Russian…

Read more

Business / Business & Strategy

Brazil crop weather in 2023 is challenging years like 2015

Weather conditions in Brazil so far this spring have been poor in many areas and if a turnaround does not occur soon production may be notably off the trend as…

Read more

Business / Business & Strategy / REPORT

China’s grain feed use on upswing

China’s grain feed and residual use in marketing year 2023-24 is projected to rise slightly to 285 million tonnes, up 2.7% from 282.3 million tonnes in 2022-23, according to a…

Read more

Business / Business & Strategy / REPORT

IGC: World soybean output up 7% year on year

IGC: World soybean output up 7% year on year. The International Grains Council (IGC) in its latest Grain Market Report revised global soybean production higher in marketing year 2023-24 to…

Read more

Business / Business & Strategy / Tax & Home Loan / UKRAINE

Ukraine ‘humanitarian corridor’ exports near 4 million tonnes

Ukraine has exported nearly 4 million tonnes via its “humanitarian corridor” since shipments started in August, Ukrainian President Volodymyr Zelenskiy said on Nov. 14, Reuters reported.

Read more

Business / Business & Strategy / REPORT

USDA lowers corn, wheat area forecast

WASHINGTON, DC, US — The US Department of Agriculture on Nov. 7 projected area planted to soybeans to expand in 2024, but wheat and corn planting areas were forecast to…

Read more

Business / Business & Strategy / IMPORT / REPORT

FAO forecasts record cereal output

Global cereal production this year is forecast to reach a record 2.81 billion tonnes, according to the Food and Agriculture Organization of the United Nations’ latest Cereal Supply and Demand…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Argentine wheat crop revised lower.

Due to widespread dry conditions, Argentina’s wheat production forecast for the 2023-24 marketing year has been revised lower in the most recent Global Agricultural Information Network report from the US…

Read more

Business / Business & Strategy / REPORT

Rabobank: US could still see top corn crop

While the US will not set yield records in corn this season, far better results than initially anticipated could still make it a top-two or top-three crop, according to Rabobank’s…

Read more

Business / Business & Strategy / REPORT / TIPS & GUIDES

Ocean freight rates for US grain dropped in the third quarter.

Ocean freight rates for shipping grain from the US Gulf and Pacific Northwest dropped in the third quarter compared to the previous quarter and from a year ago, according to…

Read more

Business / Business & Strategy / REPORT

Bunge marks 100 years in Australia

Bunge Ltd. is marking a century in Australia throughout October, hosting an event with more than 100 local partners at Lake Towerrinning, Moodiarrup, Western Australia, and giving back to the…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Russia signs grain export deal with China.

A Russian export company has signed a deal to export 70 million tonnes of grain, legumes and oilseeds to China, Reuters reported on Oct. 18. The company, EPT, said the…

Read more

Business / Business & Strategy / EXPORT / REPORT

Ukraine says nearly 300,000 tonnes of grain destroyed.

Russia’s attacks on Ukraine’s agricultural infrastructure and ships since July have destroyed nearly 300,000 tonnes of grain, Reuters reported, citing the Ukrainian government. Since Russia quit the Black Sea Grain…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

UN, Russian officials discuss grain exports

Talks aimed at providing Ukraine and Russia “unimpeded access” to global grain and fertilizer markets were held between the United Nations and Russian officials Oct. 9 in Moscow, Reuters reported.…

Read more

Business / Business & Strategy / REPORT

Bunge shareholders vote for Viterra acquisition

Bunge Ltd. shareholders on Oct. 5 voted in favor of the company’s acquisition of Viterra Ltd., approving the issuance of 65,611,831 common shares, par value of 1¢ per share. The…

Read more

Business / Business & Strategy / EXPORT / UKRAINE

More ships using Ukrainian seaports

Three ships left Ukrainian ports on Oct. 1, and five more ships are on their way to ports using a new corridor opened by Ukraine mainly for agricultural exports as…

Read more

Business / Business & Strategy / UKRAINE

Ukraine exports plunge by 51%

Ukraine grain exports from Sept. 1-24 fell by 51% compared with the same period in 2022, Reuters reported, citing data from Ukraine’s agriculture ministry. The war-torn country has seen its grain infrastructure under…

Read more

Business / Business & Strategy / REPORT

US HRW wheat exports projected at record low

US Hard Red Winter (HRW) wheat exports are forecast to fall to their lowest level since the US Department of Agriculture (USDA) began tracking such data in 1973, according to…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Poland to extend embargo of Ukraine grain

Poland announced on Sept. 12 that it will not lift its embargo of imports of Ukrainian grain this week as originally planned. Poland Prime Minister Mateusz Morawiecki said resuming imports…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Argentina anticipates rebound in soybean crop

Argentina’s soybean crop is expected to rebound in the 2023-24 crop year to an estimated 50 million tonnes, up from 21 million tonnes last season, according to a Sept. 7…

Read more

Business / Business & Strategy / REPORT

Brazil overtakes US as top corn exporter

Brazil will overtake the United States as the world’s top corn exporter in the 2022-23 marketing year and is projected to be the leading exporter in 2023-24 as well, according…

Read more

Business / Business & Strategy / REPORT

Canada enters GM corn dispute

The Canadian government announced on Aug. 25 that it will participate as a third party in the dispute settlement proceedings between the United States and Mexico regarding the use of…

Read more

Business / Business & Strategy / REPORT

Grain market review: Oilseeds

World oilseed prices rose in July after months of falls, with sunflower, notably, rising because of uncertainty over Black Sea shipments and new crop supplies looking tight ahead of harvest.…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT / UKRAINE

Romania to boost Ukrainian grain exports

With additional staff and the completion of EU-funded infrastructure projects, Romania said it could double its monthly transit of Ukrainian grain to its Black Sea port of Constanta to 4…

Read more

Business / Business & Strategy / REPORT

Brazil’s corn, and soybean estimates were revised higher

Brazil’s crop estimating agency, Conab, on Aug. 10 raised its official corn crop estimate for the current marketing year to a record 129.9 million tonnes, up 2.2 million from its…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Cargill revenues rise 7% to $177 billion

Excellent execution” and “customers’ partnerships” helped Cargill deliver an increase in revenues in the fiscal year ended May 31. At $177 billion, revenues were up 7% from fiscal 2022, the…

Read more

Business / Business & Strategy / REPORT / UKRAINE

Russia’s gambit in Ukraine

Russia’s exit from the Black Sea grain deal, followed by barrages of strikes unleashed on ports in Odesa, the Mykolaiv River, and most recently, the Danube River, threatens to plunge…

Read more

Business / Business & Strategy / REPORT

Canada plants more wheat at the expense of other grains

Canada’s wheat area hit its highest level since 2001 as farmers looked to benefit from strong prices and lower input requirements, according to a report from the Foreign Agricultural Service…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Russia hits grain infrastructure on Danube River

Russia has continued its attack on Ukraine’s grain infrastructure, destroying a grain warehouse on the Danube River in a drone attack on July 24, Reuters reported. Since leaving the Black…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Russia Pulls out of Black Sea grain deal

Russia announced on July 17 it was suspending its participation in the Black Sea Grain Initiative which for nearly a year has allowed safe passage of Ukraine grain exports via…

Read more

Business / Business & Strategy / IMPORT

US winter wheat forecast surprises analysts

The US Department of Agriculture (USDA) in its July 12 Crop Production report forecast US 2023 winter wheat production at 1.206 billion bushels, up 6% from the June forecast of…

Read more

Methods in flour mill analysis and adjustment

The following are quotes from a statement “Milling – A Profession” in a 1945 Association of Operative Millers (AOM)Technical Bulletin: “Each year, each month, almost each day the material the…

Read more

Business / Business & Strategy / REPORT

US grain group objects to ultra-processed focus

The term “ultra processed” is ill-defined and not deeply studied and would be of questionable value as a key criterion for dietary guidance, according to The Grain Chain, a grains…

Read more

Business / Business & Strategy / REPORT

Canadian wheat plantings have reached a recent high.

Area planted to wheat in Canada surged to its highest level in more than two decades, one of several crops to see an uptick in planting in 2023, according to…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Ukraine convinced Russia will exit grain deal.

Ukraine is nearly certain Russia will leave the Black Sea Grain Initiative as its renewal date approaches because Russia is developing an alternative for its ammonia exports, Reuters reported, citing…

Read more

Business / Business & Strategy / REPORT

Bunge’s turnaround impressive

In a 2021 interview with Sosland Publishing Co. President and Milling & Baking News editor Josh Sosland, Bunge Chief Executive Officer Gregory Heckman hinted that a seismic transaction, like the…

Read more

Business / Business & Strategy / REPORT

Bunge, Viterra agree to $18 billion merger.

Bunge and Viterra announced on June 13 that they have agreed to a merger that will create one of the world’s largest agribusiness firms, moving it closer in size and…

Read more

Business / Business & Strategy / REPORT

Bunge, Viterra reportedly inching closer to deal.

Negotiations of a potential merger between agribusiness giants Bunge Ltd. and Viterra have reached a critical stage as the companies attempt to put the final touches on a deal that…

Read more

Business / Business & Strategy / REPORT / UKRAINE

Wheat prices rise with Ukraine dam breach.

As millions of liters of water poured through a breached dam in southern Ukraine threatening regional villages and water supplies, worries about an escalation of the war between major grain…

Read more

Business / Business & Strategy / REPORT

China’s wheat quality is taking a hit from heavy rains ahead of harvest.

Heavy rain just ahead of harvest in China’s central Henan province is increasing wheat prices and raising concerns about quality, Reuters reported. The rain is causing some of the wheat…

Read more

Business / Business & Strategy / REPORT

Converting food waste to feed

Food waste often is considered any food that was not used for its intended purpose and has otherwise been discarded to a landfill. In 2010, the US Department of Agriculture…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Ukraine says it has alternatives if Black Sea Grain Initiative not extended

Ukraine said it has alternate ways of transporting grain if the Black Sea agreement is not extended on May 18, Reuters reported. The agriculture ministry said not extending the agreement,…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Bunge Q1 earnings fall short of last year’s record

First-quarter earnings at Bunge Ltd. fell short of last year’s record results, dragged down in part by sluggish oilseed processing results in Argentina, Asia and Europe, which more than offset…

Read more

Business / Business & Strategy / EXPORT / IMPORT

Australian wheat output projected to decline

After three consecutive years of record-setting wheat crops in Australia, production in marketing year 2023-24 is forecast to dip 25% from the previous year to what would still be the…

Read more

Business / Business & Strategy / REPORT

US soft red winter wheat forecast at 405 million bushels

A panel of flour millers and wheat merchandisers on April 25 forecast soft red winter wheat production in the United States in 2023 at 404.923 million bushels, up 68.297 million…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT / UKRAINE

EU plans help for farmers in countries bordering Ukraine

The European Union (EU) is planning a package worth 100 million euros ($109.32 million) to support farmers as countries bordering Ukraine have begun to restrict imports of Ukrainian cereals that…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Bunge to acquire multi-oil refinery

Bunge Ltd., through its Bunge Loders Croklaan joint venture with IOI Corporation Berhad, has entered an agreement to acquire a newly constructed, port-based refinery from Fuji Oil New Orleans, LLC.…

Read more

Business / Business & Strategy / REPORT

US spring wheat plantings at a 50-year low

The US Department of Agriculture’s March 31 Prospective Plantings report brought some surprises but may ultimately yield to weather as the primary final planting factor this spring. The USDA said…

Read more

Business / Business & Strategy / EXPORT / REPORT / UKRAINE

Cargill to stop elevating Russian grain exports.

Citing mounting challenges to its grain export operations in Russia, Cargill will cease elevating Russian grain in the new export season that begins July 1.

Read more

Business / Business & Strategy / EXPORT / IMPORT

Focus on South Korea

With less than a quarter of its land used for agriculture, South Korea relies heavily on imports, particularly wheat and corn, while producing a significant amount of rice.

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Grain market review: Oilseeds

A likely record Brazilian crop, with Argentina’s production problems already factored in, and subdued demand were at the top of the list of factors behind easing oilseeds prices in recent…

Read more

Business & Strategy / EXPORT / IMPORT / REPORT / Tax & Home Loan / TIPS & GUIDES

Bunge joins canola collaboration

Bunge will collaborate with Corteva Agriscience and Chevron U.S.A. Inc., a subsidiary of energy giant Chevron Corp., to introduce proprietary winter canola hybrids that produce plant-based oil with a lower…

Read more

BASF announcement surprises wheat industry

With global wheat supplies tightening due to climate change and the war between Russia and Ukraine, two of the world’s biggest wheat producers and exporters, finding ways to maximize wheat…

Read more

Business / Business & Strategy / IMPORT / REPORT

Kazakhstan’s wheat, barley production improves in 2022-23

Wheat and barley production in Kazakhstan improved in 2022-23, with both experiencing a 39% increase from the previous year, according to a report from the Foreign Agricultural Service of the…

Read more

Business / Business & Strategy / REPORT / UKRAINE

Russia may abolish grain export quota

Russia, the world’s largest wheat exporter, is considering abolishing its grain export quota

Read more

Business / Business & Strategy / ORGANIC FOOD / REPORT

Companies betting on plant-based protein

With 52% of global consumers identifying as flexitarians (incorporating both animal-based and plant-based proteins into their diet), according to a Mintel market research report, oilseeds and legumes processors stand to…

Read more

Business / Business & Strategy / ORGANIC FOOD

Market for organic products must be nurtured

While still accounting for only a modest share of grain-based foods in the United States, the market for organic products has been highly dynamic and must be nurtured and protected.…

Read more

Business / Business & Strategy / REPORT

Brazil expected to produce record grain volumes

Brazil is set to have another record-breaking grain harvest in 2022-23 with wheat production estimated at 9.6 million tonnes and corn production at 125.5 million tonnes, according to a report…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

China corn production on upswing

Corn production in China for 2022-23 is trending higher at 277.2 million tonnes, up 1.7%, or 4.6 million, from last year, and feed mills have resumed mixing more corn amid…

Read more

Business / Business & Strategy / EXPORT / REPORT

French soft wheat exports outside the EU on rise

The forecast for 2022-23 soft wheat exports from France outside the European Union has continued to climb to 10.6 million tonnes, 21% more than last year, on strong demand from…

Read more

Business / Business & Strategy / REPORT / TIPS & GUIDES

U.S. flour production falls to seven-year low in 2019

Wheat flour production by U.S. flour mills in 2019 totaled 422.277 million cwts, down 4.594 million cwts, or 1.1%, from the record 426.871 million cwts in 2018 and the smallest…

Read more

Business / Business & Strategy / EXPORT / IMPORT

India eyes better year for wheat

Higher prices and better weather could help India’s wheat production take a leap forward with farmers planting high-yielding varieties in a wider area, Reuters reported, citing scientists and traders in…

Read more

Business / Business & Strategy / EXPORT / UKRAINE

Ukraine urges faster ship inspections

Ukraine sees faster ship inspections, rather than opening additional ports, as the key to increasing its exports under the Black Sea Grain Initiative, Reuters reported, citing a senior Ukrainian government…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

Grain market review: Coarse grains

Concerns over the world economy and its effect on demand, and spillover from declines in wheat, pushed prices for maize lower in December. Worries over potential problems with shipments through…

Read more

Business & Strategy / Human Resorce / REPORT

National Foods mill on track for commissioning in 2023

National Foods Holdings Ltd., a manufacturer of branded food and feed, is on track to start operations at a new mill in Bulawayo, Zimbabwe, in early 2023, said Todd Moyo,…

Read more

Business / Business & Strategy

Cargill to acquire soybean processor

Expanding its oilseeds network, Cargill has entered a definitive agreement to acquire Owensboro Grain Company, LLC, a fifth-generation family-owned soybean processing facility and refinery located in Owensboro, Kentucky, US.

Read more

Business / Business & Strategy / REPORT / UKRAINE

Satellite images reveal plentiful Ukraine crop

Ukraine farmers in 2022 harvested fewer tonnes of wheat than in the record-setting previous crop year, but close to the recent five-year average volume, according to analysis of satellite imagery…

Read more

Canadian feed company acquires grain processing plant

a manufacturer of nutritional products for animals, has acquired a grain and processing facility in Slemon Park, Price Edward Island, Canada.

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT / UKRAINE

Global grain trade review

The grains market has moved this year from handling an unprecedented worldwide pandemic to dealing with a war involving two of the planet’s biggest exporting nations. At the same time,…

Read more

Business / Business & Strategy / REPORT

China’s soybean imports hit the lowest level since 2014

China’s soybean imports hit their lowest level for any month since 2014 this October, according to customs data, Reuters reported.

Read more

FAO Cereal Price Index rises again

The benchmark for world food commodity prices was broadly stable in October, with rising cereal prices more than offset by declines in quotations for other staples, the Food and Agriculture…

Read more

Business / Business & Strategy / EXPORT / REPORT

Russia suspends participation in grain deal

Despite Russia proclaiming that it has suspended its participation in the United Nations-brokered grain export deal with Ukraine, grain ships continued to exit Ukraine’s Black Sea ports on Oct. 31,…

Read more

Business / Business & Strategy / EXPORT

India says its wheat, rice stocks sufficient

Following a summer of concern, India’s stocks of rice and wheat have been pronounced sufficient, and wheat could be sold by the government to help control domestic prices, if necessary,…

Read more

Business / Business & Strategy / EXPORT / REPORT

Argentine wheat crop projections continue to fall.

Drought-stricken Argentina’s 2022-23 wheat crop projections continue to trend downward as the country’s two major grain exchanges cut their forecasts on Oct. 13, according to Reuters.

Read more

Business / Business & Strategy / EXPORT / IMPORT

FAO sees drop in global grain output

The United Nations’ Food and Agriculture Organization (FAO) projected a further reduction in global grain production in its latest Cereal Supply and Demand Brief, released on Oct. 6. The FAO…

Read more

Business / Business & Strategy / EXPORT / UKRAINE

FAC examines impact of war on global food security

The Food Assistance Committee (FAC) during a meeting on Sept. 30 discussed the impact of Russia’s invasion of Ukraine on global grain markets

Read more

Business / Business & Strategy / EXPORT / REPORT

Ukraine shipments near 5 million tonnes

Nearly 5 million tonnes of agricultural products have been shipped from Ukraine’s Black Sea ports since the United Nations and Turkey brokered a deal on July 22, allowing grain shipments…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

War has taken toll on Ukraine’s grain storage facilities

One out of every six, or about 15%, of Ukrainian crop storage facilities, have been destroyed, damaged or controlled by Russia and its aligned forces since it invaded Ukraine on Feb. 24,…

Read more

Largest convoy yet of grain vessels leaves Ukraine

Ukraine dispatched 13 ships from its ports on Sept. 4 carrying 282,500 tonnes of agricultural products, its biggest convoy of grain vessels so far under an UN-brokered deal, Reuters reported.

Read more

Business / Business & Strategy / EXPORT / REPORT

India denies reports that it plans to import wheat

Although wheat production is forecast to fall to its lowest level in four years, India’s government on Aug. 21 reiterated that it had no plans to import wheat, Reuters reported

Read more

Business / Business & Strategy / EXPORT / UKRAINE

Black Sea Grain Initiative exports top 560,000 tonnes.

More than 560,000 tonnes of grain has been exported from Ukraine’s Black Sea ports since Russia agreed to lift its naval blockade on July 22, according to the Joint Coordination…

Read more

First Ukrainian grain ship headed to Africa

A ship is nearing Ukraine to pick up wheat for Ethiopia, making it the first food delivery to Africa under an UN-brokered plan to deliver grain trapped by Russia’s war,…

Read more

Business / Business & Strategy / EXPORT / IMPORT / REPORT

World’s top wheat-producing countries

In 2022-23, the International Grains Council’s July report anticipates worldwide wheat production to reach 770 million tonnes, down from 781 million tonnes in 2021-22, with 195 million tonnes available for…

Read more

Business / EXPORT / ORGANIC FOOD

Rain hurts Russian winter wheat quality

The quality of Russia’s winter wheat crop, which accounts for nearly three-fourths of the nation’s annual production, has taken a hit following recent rains in several regions with more expected…

Read more

Turkey plans to import more wheat in 2022-23

Turkey plans to import more wheat in 2022-23 to meet domestic food and feed demand, strengthen country stocks and meet stable demand from wheat product producers and exporters, according to…

Read more

First Ukrainian grain ship leaves Odesa under brokered deal

The first ship carrying Ukrainian grain under a deal brokered by Turkey and the United Nations left the port of Odesa on Aug. 1, carrying 26,000 tonnes of corn destined…

Read more

Brazil on pace for record corn production, exports

Corn exports from Brazil have increased by 221% in the first half of 2022 as importers seek to replace Ukrainian corn that isn’t making it to market due to the…

Read more

China expected to import less soybeans

Slower economic growth, high prices and COVID-related restrictions have lowered China’s soybean import expectations for 2021-22, according to a report from the US Department of Agriculture’s Foreign Agricultural Service (FAS)

Read more

Argentina grain exports stymied by trucker protest

Loaded grain trucks were not getting to Argentina’s largest port on June 29 as a truck driver protest against high fuel prices brought the country’s agricultural exports to a near…

Read more

Russia may switch grain export tax to rubles

Russia is considering a gradual switch for state export taxes for grains and sunflower seeds from US dollars to rubles at the behest of commodities traders.

Read more

Grain market review: Wheat

World wheat markets are at their highest price levels since 2008 as reduced supplies, held back by the conflict in Ukraine, a move by India to limit shipments abroad, and…

Read more

Brazil corn production revised upward

Brazil is projected to harvest a larger second corn crop this year as timely rainfall has lessened the severity of drought in the South American country.

Read more

Global Index Ranks 2021 Port Performance In Processing Containers

Global Index Ranks 2021 Port Performance in Processing Containers

Read more

Slow Growth In Organic Food Sales As Pandemic Fades

Slow growth in organic food sales as pandemic fades

Read more

China winter wheat harvest passes halfway mark

China had finished reaping winter wheat on about 11.13 million hectares of farmland by June 6, reaping the crop on more than 667,000 hectares daily for eight consecutive days after…

Read more

Brazil’s soybean production facing fertilizer challenges

Brazil is expected to slow its soybean planting expansion in 2022-23, with just a 0.5% increase year-over-year, down from the 3.8% annual growth rate last year.

Read more

Richardson to build new grain elevator in Alberta

Richardson Pioneer Ltd. plans to build a new high throughput grain elevator in High Level, Alberta, Canada. The new elevator will include 32,000 tonnes of storage space and will be…

Read more

Argentina farmers dealing with uncertainty

The upcoming presidential election and troubling economic conditions have cast a cloud of uncertainty over Argentina grain and oilseed producers entering the 2019-20 crop season, according to an April 11…

Read more

Brazilian corn production on the upswing

Expanded acreage and good weather during the safrinha growing season is expected to increase Brazil’s 2018-19 corn production by 18% over the previous market year. That trend is expected to…

Read more